- CROWDSCALE

- Posts

- Retail Investors Win the Kentucky Derby!

Retail Investors Win the Kentucky Derby!

+ key AI updates

A warm welcome to the 398 new readers that have joined since last week - it’s getting cozy in here. Some of y’all are gonna have to start sharing blankets.

In today’s newsletter:

🏇 Pony Up: These retail investors are getting paid Kentucky Derby winnings

🧠 Artificial Intelligence Briefing: here’s what you need to know

☔️ April Showers: Funding update for April, Wefunder rained it in

Over the weekend, we got to see ‘the most exciting two minutes in sports’ - the 149th edition of the Kentucky Derby. Many people don’t know this, but you actually could have owned a minority ownership in one of the horses for just $50.

Through a site called Commonwealth, retail investors could purchase a percentage of the thoroughbred Mage for $50/share. Buying stakes in horses is jussssst out of my wheelhouse, so digging through their SEC filing was fascinating.

One of my favorite discoveries was a chart of Mage’s lineage traced back 3 generations in the document. Very important for the Securities and Exchange Commission to know this.

Jokes aside, 391 retail investors decided to pony up and scoop up shares in Mage. Investors receive a payout on any winnings by the horse, proportional to their ownership amount.

Mage entered the race with 15/1 odds and managed to win after a last-minute push to breeze by Angel of Empire. The Kentucky Derby boasted a prize pool of $3 million, with $1.86 million awarded to the winner.

Reports suggest that each share in Mage will receive a payout of $94.52. Therefore, a $500 investment would have yielded $945.20 in the race on Saturday. And while this is a decent return, some have pointed out that simply placing that same $500 on a pre-race bet would’ve returned roughly $8,000!

A fair callout, but there’s no guarantee that Mage would have won the race. And whereas investors would receive some sort of payment for any prize placement, bettors would have lost their entire wager had Mage gotten 2nd or 3rd.

Another consideration is that investors are entitled to Mage’s lifetime winnings, which could really add up over time.

Ultimately, I don’t think that racehorse ownership is the most prudent of investments. However, I acknowledge that it’s cool that this opportunity is accessible to anyone with $50 to spare. For those that derive significant enjoyment from the ownership elements, I would consider it a hobby as opposed to sound investing strategy.

The development of AI is moving at breakneck speed. I think this technology will be a major inflection point that creates (and destroys) many businesses. Here’s some of the latest updates:

Meta released a demo of its lifelike avatars. These realistic 3D renderings look like you, talk like you, and connect to AI to generate conversation

IBM is freezing hiring and expects 7,800 jobs (nearly 1/3 of its workforce) to be replaced by AI

Chegg stock dropped 48% in one day, wiping out nearly a billion dollars in value. The drop was triggered during the company’s earnings call, where management shared that ChatGPT is hurting its new customer growth

Inflection points are a ripe opportunity for successful businesses…Wefunder currently has 14 AI startups raising money from retail investors - check them out here

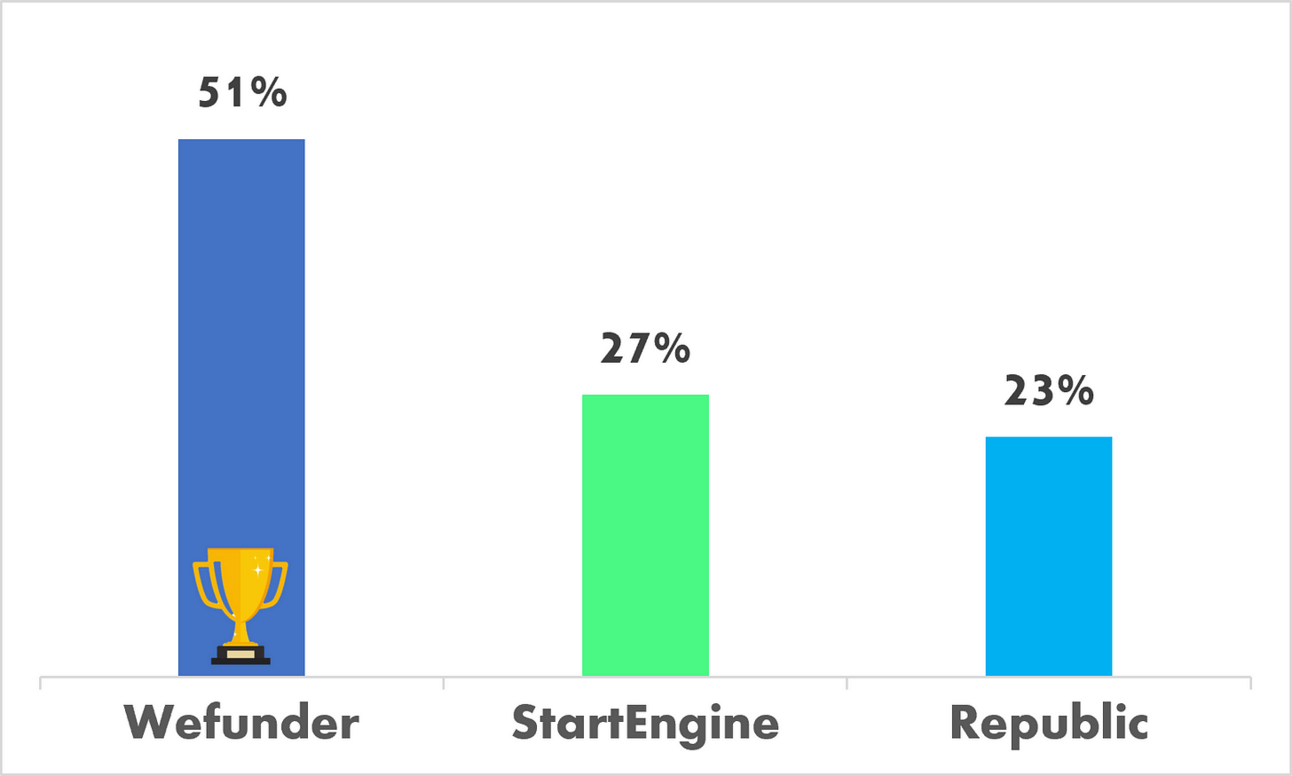

April’s crowdfunding figures are out, and there’s a clear winner. According to data from Kingscrowd, Wefunder raked in over 50% of all crowdfunding dollars across Reg CF + Reg A.

For a market that’s fragmented into 4-5 major players (plus a dozen of smaller operators), that’s one hell of a month. Wefunder’s success was partially driven by the blockbuster Substack round, which maxed out the $5M cap within days.

I’d be curious to see if Substack’s raise was responsible for driving significant investment in other companies across its platform…

That’s it for this week! Please consider sharing this newsletter with someone you think would enjoy it - I’m trying to fill in those damn gray states below! :)

Reply